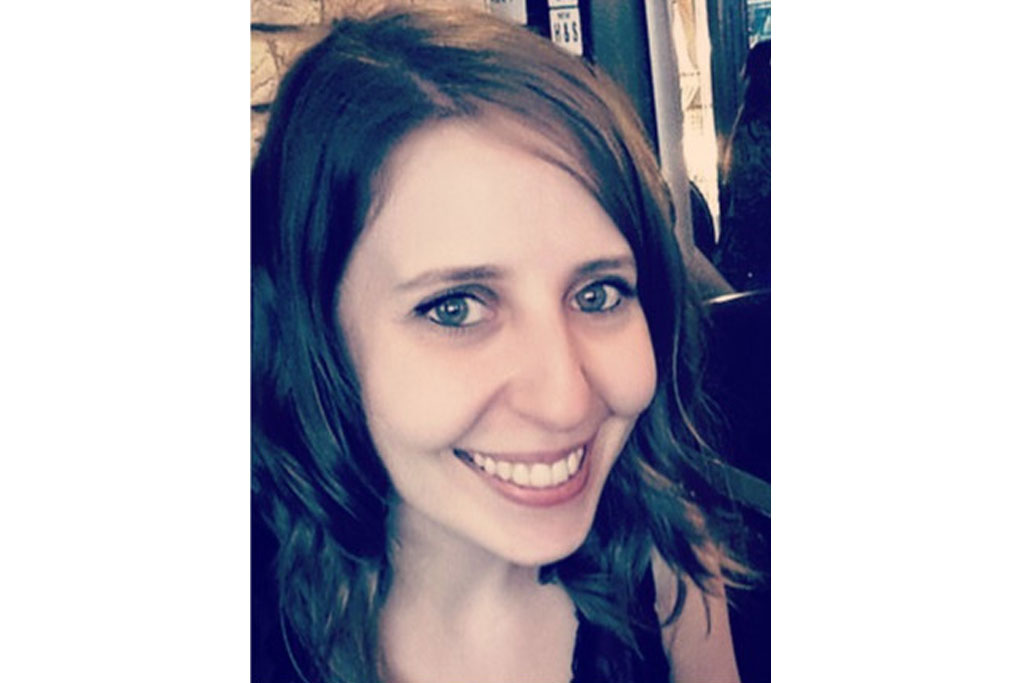

Zaina Harb joins Aquarium team to deliver quality customer service

November 11, 2019Aquarium on the shortlist for the National Insurance Awards

December 19, 2019Aquarium Software has written a new white paper looking at the future of the insurance industry. We take the view that, to date, the insurance industry has been insufficiently impacted by digital transformation and that we are on the cusp of a new era that will witness sweeping changes over the next few years. We believe that the entirely digital insurance proposition is imminent.

Insurance is one of the few products that people buy hoping never to use. In the past two decades, we have seen the rapid growth in popularity of online price comparison web sites with consumers aiming to get the best deal on insurance policies. This in turn puts pressure on insurers to stay fiercely cost competitive – too often at the expense of customer service.

At Aquarium, our experience working with insurers is that cost cutting in customer service delivers short term gain, but long-term pain. The short-term savings are quickly outweighed by the longer term issues of consumers getting frustrated by automated call centres or having to explain the details of a claim to different customer service advisors every time they call to get an update on a policy or a claim.

Digital transformation is more than the replacement of a non-digital processes. Digital transformation will radically reshape the way that people purchase insurance, settle claims and will eradicate the need for human intervention in all but the most complex cases. The most effective technology deployments achieve both the reduction of manual intervention and increasing data insight. Technologies such as smart mobility, voice interaction, optical character recognition and machine learning enable insurers to achieve this for their businesses, transforming not only the speed and accuracy of the insurance proposition but also improving customer interaction.

This will result in a far more frictionless and integrated experience for consumers and more effective business processes for insurers. Buying insurance through a smartphone app will be the absolute norm, as will making claims in the same way. Certain events will trigger automatic claim payments. In travel insurance, for example, a flight being late may result in an automatic payment to a customer even before the delayed flight has taken off. Bags being delayed may trigger the delivery of an emergency pack of toiletries to a traveller’s hotel.

Within the next five years, we will see a step-change in the way the industry behaves, based on insight from big data and smarter use of technology. This will deliver a more personalised and relevant insurance experience to consumers, driving customer loyalty, reducing cost and risk and ensuring that the industry can enhance its reputation and deliver a vastly more efficient service to the public.

Aquarium is already working with some of the largest brand names in insurance to go beyond disruption and to deliver the transformation that insurers and consumers will reap widespread benefits from.

To read the White Paper click here